The Importance of Making Your Kids Acquainted With Money Management

There a wide range of parents who’re prepared to make their children conscious of the financial planning and the strategies forced to come up with a good financial future. The major cause of parents wanting to do it is because they do not want their kids to fall into a card scam or even bankruptcy. They want their children growing up into financially responsible and stable people who know the location to pay their funds and ways to save it.

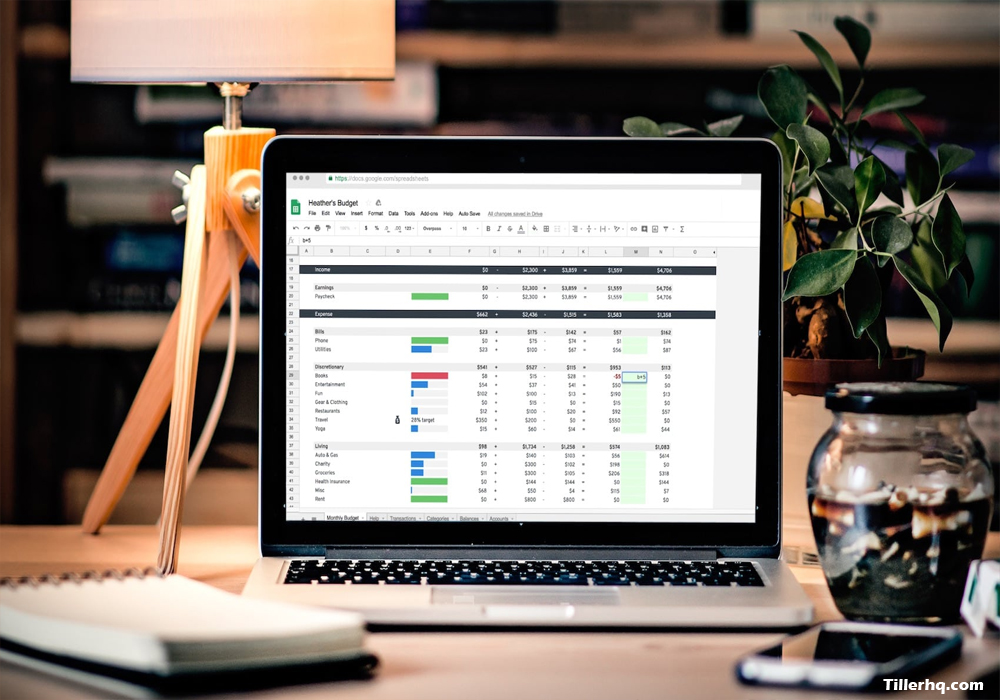

I will see why the concern of many from the parent towards their kids. But the trouble with here’s that lots of parents do not know how to begin giving their kids information regarding personal finance management and ways to begin it. Surely you can not afford to begin with the tax calculation tool of cash management software to some 10-year-old child.

You will invariably have to start in the …

The Importance of Making Your Kids Acquainted With Money Management Continue Reading >>>