Proper financial management – most coveted by millions and millions of clients all over the globe. Faced with this tough economy, it is harder than previously to address finances well. But the nice thing about it is always that establishing a solid financial plan for your future has become less costly and attainable. There are a lot of online personal finance tools that you can get to people free to assist them to manage their finances better. These are effective instruments for being financially stable while saving yourself from getting into debt trouble.

In today’s modern time, tracking each detail is very hard and much more difficult when money is the matter. Thus, getting aid from online personal finance tools sounds very beneficial. Also, this equipment comes free and very handy. Calculating your dollars inflow and outflow can be easily carried out in the comfort of your property facing laptop computer.

Personal finance is a method of following your finances inside a streamlined manner. Since listing down with a paper every piece of information about one’s expenditures won’t function better any longer, an individual finance device located online provides much bigger and assistance.

The following are some of the best online personal finance tools from budgeting to checking one’s credit history that you can get to individuals for free:

1.) For Money Budgeting

is probably the most favored and well-loved online for free personal finance tools with the people. With over 8,000 financial company connections worldwide, this online means comes with a wide array of understandable and straightforward to work with tools.

Once you have registered a free account, you get 100% access to the whole finances, for example, your charge cards, grocery bills, loans along with other personal expenses.

It supplies a very detailed tracking program about precisely what continues with your money from – the things you spend your cash on, just how much monthly savings you’ve got together with your investment’s performance.

Automatic alerts may also be given to you through a message or even an e-mail especially when you are well on the brink of reaching your card’s credit limit or if you have not enough money deposited with your bank account.

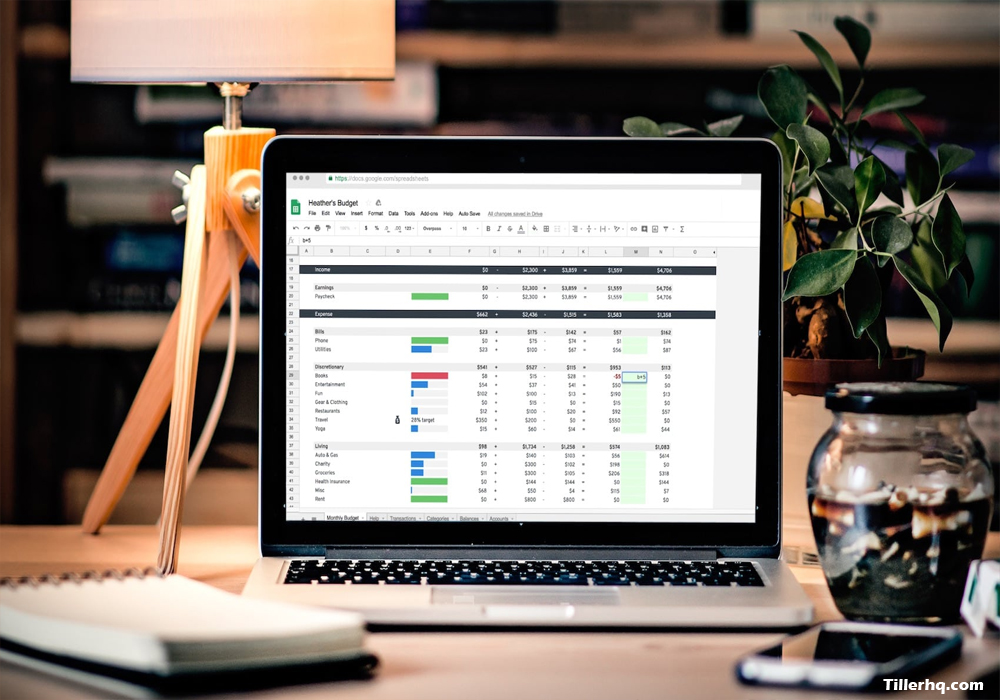

Also about bat roosting services, this online tool could demonstrate budgeting charts and spreadsheets that explain how you can budget in every expense category.

2.) Wesabe

is often a website that provides strong financial management instruments while at the same time having that online community appeal because it offers an active forum for clients who are looking for support and present encouragement to each other to reach their respective monetary goals.

Since it is a more hands-on website in comparison with Mint, you have the choice of putting your bank or charge card statements by yourself. Since this is not done automatically, you safeguard your identity and also important details such as your numbers and passwords better.

3.) Buxfer – For Financial Planning

A more basic and much less updated online for free personal finance tool based on the web, it is best for individuals that are looking for fuss-free financial planning instruments.

However, electronics equipment? stand out among other online financial planning device is its user-friendly interface. Buxfer is equipped with a step-by-step how-to guide, obvious to see instructions in addition to fast account build.

4.) Social Picks – For Investment Tracking

is a business based online company that focuses on tracking an individual’s investments. It provides a completely independent service wherein it is simple to gain access to your asset’s performance while at the same time enabling you to make comparisons to investors. Financial advice can be given to enable you to advertise your investment better.

5.) For Credit Score Checking

Functions exactly like your credit score bureau company, this website gives you an updated status of your respective credit history. Also, advice emerged about how it is possible to boost your rating as well as tips on how it is possible to repair a rating with glitches.

The only main difference is always that you will not need to provide your bank card details. All you’ve got to type in can be your name, address, and SSS (Social Security Number).

Online personal finance tools are excellent devices keeping in mind yourself current with your money current status while at the same time giving you produce financial planning far better without the scare of having scammed.