Learn Powerful Money-Saving Ideas Your Private Finance Professional May not Tell you

Our private finances often weigh heavily on our minds. It seems that some individuals possess a knack for keeping theirs in order, even though other folks tend to struggle. In spite of the truth that a few of us have an a lot easier time or much more financial means than others, we can all get them in order if we’ve the expertise to perform so. In this post you may uncover ideas and suggestions for undertaking just that.

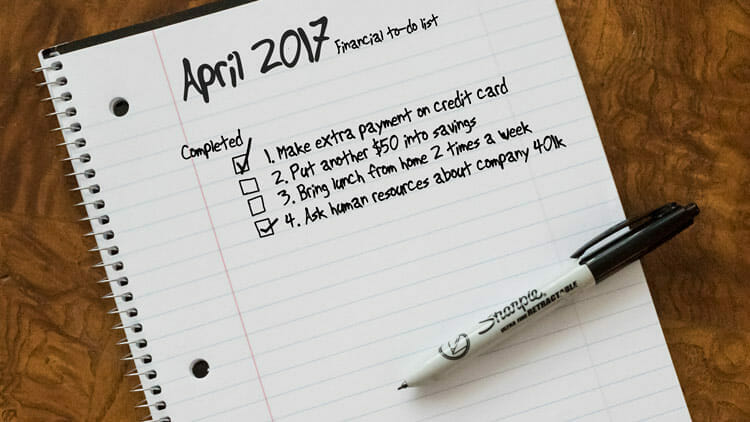

Americans are notorious for spending more than they earn, but if you want to be in charge of the finances, commit less than what you earn. Budget your income, as to assure that you simply don’t overspend. Spending less than what you earn, can help you to become at peace together with your finances.

Attempting to remain as healthful as you can and curing any minor sicknesses at home …

Learn Powerful Money-Saving Ideas Your Private Finance Professional May not Tell you Continue Reading >>>