Personal Finance Software – The very best Solution to Manage Your Private Finances

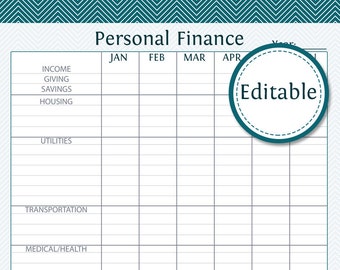

It’s a good notion to become organised when handling your private finances – dwelling budgeting and individual budgeting are very important should you wish to prevent debt. However, we do not all possess a great deal of spare time to sort out our finances and I consider the answer could be to purchase some personal finance software program.

Which Personal Finance Software?

There is a massive selection of personal finance software program to select from. These software packages variety from very simple programs where you record earnings and expenditure to the more sophisticated which permit you to import bank statements, appear immediately after your investments, set up budgets ( both for household and individual) and schedule payments.

Even if your requires are extremely simple in the moment, it really is likely greater to purchase application with all the more capabilities as they are going to probably be pretty beneficial within …

Personal Finance Software – The very best Solution to Manage Your Private Finances Continue Reading >>>

In specific the management of income. This can be individual income, organization cash or public funds.

In specific the management of income. This can be individual income, organization cash or public funds. Silicon Valley Blogger, SVB for quick, is one of our 5 Cash Grows on Hubs judges, and is the blogger behind The Digerati Life – a largely Private Finance-oriented weblog which combines posts on cash, organization, technology, and SVB’s entrepreneurial endeavors.

Silicon Valley Blogger, SVB for quick, is one of our 5 Cash Grows on Hubs judges, and is the blogger behind The Digerati Life – a largely Private Finance-oriented weblog which combines posts on cash, organization, technology, and SVB’s entrepreneurial endeavors. The Place to Go Online if You Are a Hippie, Bohemian, or Free Spirit in Need of Employment!

The Place to Go Online if You Are a Hippie, Bohemian, or Free Spirit in Need of Employment! Remittance volumes handled by UAE Exchange surged 135 per cent last week compared to the same week a month earlier.

Remittance volumes handled by UAE Exchange surged 135 per cent last week compared to the same week a month earlier.